2018 North Harbor Wealth Management Playbook

NHWM Statement

NORTH HARBOR WEALTH MANAGEMENT VISION STATEMENT:

To be the most well respected and referred financial planning and wealth management firm in the State of Alaska and western United States.

NORTH HARBOR WEALTH MANAGEMENT MISSION STATEMENT:

Our mission is to work with a select group of individuals, families, and business owners to help them make sound financial decisions. Our goal is to give our clients piece of mind and the ability to grow and protect their wealth. We pride ourselves in putting the client first in every situation, even if that means lost revenue to the firm. If a mistake is made, we admit to it as soon as it is discovered and do what is required to correct the error. This process protects and our reputation.

HOW WE WORK WITH CLIENTS:

Our team uses a comprehensive process to identify where clients are now, where they want to go, and any risks or gaps that will stop them from getting there. We then work with a network of professional advisors and asset managers to help clients make informed decisions that will help them achieve what is important to them.

HOW CLIENTS GET STARTED:

We meet with clients at one of our offices to discuss their situation and our process in more detail. If we decide it would be beneficial for us to work together we will explain what the next steps would be. If we are not the right firm for a particular client or situation, we refer the client to one that is.

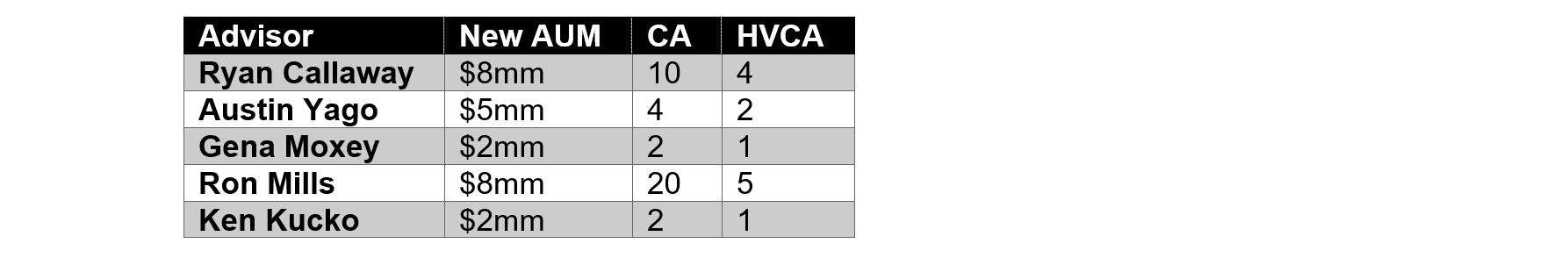

2018 Goals & Path

Goals

· GDC: 3mm minimum

· AUM: 350mm

· Plans: 110 (to lock in 91% payout grid)

· HVCs: 10 per advisor average

· Net Flows: 25 mm

Path to Goals

· EAR: Build a pipeline of EAR candidates (LTP) - BDD

o 2 new meetings a month > 2 meetings a week > 1 DD per month > 2 Offers > 1 Hire

· Practice Acquisition: Build a pipeline of PA candidates - BDD

o 1 new meeting per month > 1 meeting per week > 1 DD per month > 1 offer per year > 1 PA per year

· AUM: Build a pipeline of incoming assets

· Plans: 110 plans retained on the books to lock in 91% payout

o Engage Kucko and Mills client base and referrals

o 30 plans per AFA and BDD

· Net flows: 25mm in organic net flows

o Done though proficiency in the preferrals script and marketing

· Marketing: Create a turnkey marketing program that effectively engages clients and continues to build relationships with the practice.

· Ownership equity program rolled out in 2018

· Update employment agreements and documents

We need to continue to communicate to clients that we are creating a team approach. Clients need to feel comfortable meeting with any team member at any time. This means we need to develop a client service model and closely follow the model at every meeting.

3 Year Plan (2018-2021)

Top Goals for 3 year Plan:

1. Continue to develop a systematic and repeatable client service experience

2. Build professional alliances

3. Acquire additional high value financial planning practices

4. Continue to develop and build out our team to a regional level

Business Goals: 3 Years from today (by 2021):

· Doing $5 - 5.5 million+ GDC

o This will require assets base of +/- $600 million. Current asset base is $285 million

o Acquisitions and professional alliances will be needed to achieve this type of quantum growth

· 110+ annual financial planning relationships – to lock in 91% grid rate

· 10+ HVC’s per producing advisor per year from organic growth

· Branded in Alaska as the premier financial services firm of the highest caliber in client experience and service

· 1-3 more practice acquisitions

Our Ideal Client:

Oil and Gas industry management and north slope employees

Small and medium sized business owners

Current or retired State of AK employees

Physicians and Dentists

We can have the most impact on pre-retirees (Ages 50-65) but are willing to work with younger or older clients if they are committed to achieving their goals

Geographic Location

Salt lake city and Great Falls in addition to Central and south central Alaska however, technology has made it increasingly more simple to work with clients regardless of their geographic location.

Amount of invest-able assets

$250,000 or more of invest-able assets is preferred. We will also work with client's who are committed to reaching their goals and have a financial plan in place to increase their probability of success

Minimums - (only applies in AK) Client must generate at least $2,500 of revenue per year for practice to be part of our service .

$100,000 account minimum. Referring client for an account under this threshold must be >$500,000

Under $100,000 accounts with planning are acceptable

Financial Challenges

Asset management

Risk management

Estate planning

Tax planning

Retirement planning

General Financial Planning

Compatibility

We work best with clients who are comfortable working with a professional, act on the advice delivered, are willing to pay a fee for the advice that we offer, and follow through on their commitments

Client Model

Office Development Topics:

Total View and Hypotheticals

ABDG book review and utilization of the RSD/RSM

Advisor Mobile

Preferrals Script

GoSocial with LinkedIn

Marketing on Demand

Quick Parts & Outlook Tools

Compliance G&E policy